Bitopan Das, Department of Mechanical Engineering, School of Engineering,

Tezpur University, Assam, India

Applied Sciences, Fall 2020

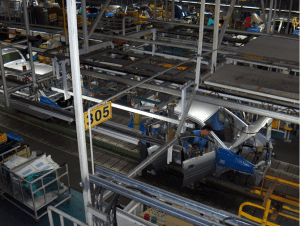

Figure: Workers working on cars lined up in an assembly line in a vehicle manufacturing plant.

Source: Wikimedia Commons

Since the start of the COVID-19 pandemic, the automotive world received a series of blows and surprises. Lockdowns, travel restrictions and the resulting fallout have affected the automotive sector in a one-of-a-kind fashion.

Before the pandemic, vehicle sales were rising and in some segments, new records were set. The forecast for auto sales in the US alone was expected to be between 16 and 17 million units during 2020. But as March came, the all-consuming COVID-19 grinded daily activities to a halt. With the prospect of a vaccine far away in the future, governments worldwide imposed lockdowns and quarantine mandates. These restrictions meant that people could not visit dealerships to buy vehicles. Also, resulting from the widespread inactivity, the world economy took a hit which has been seen as the worst since the 2008 Financial Crisis (Mordecai and Schumacher, 2020).

Layoffs occurred throughout the industry. Nissan decided to shut down its Barcelona plant after reporting the worst profit losses in a decade. This in turn drew protests from the plant workers. Likewise, production stalled elsewhere too due to temporary shutdown of plants. The nature of the auto industry being heavily dependent on global supply chains made the entire scenario worse (Li et al., 2020). Supply chains are often scattered across multiple regions of the world and each country imposed their own version of COVID regulations.

Due to widespread job losses, people started saving more instead of making big transactions like vehicle purchases, which further brought down demand. Although gasoline prices plummeted across North America (Walker, 2020), this was not associated with any positive trend in vehicle sales. New vehicle sales in the United States fell 23.9% in July this year compared to 2019. In Europe, sales dropped by about 25.7% during the same period (Madhok, 2020).

Yet people have embraced digitization more during their homestay; working from home, using online services and purchasing goods online. And because use of public transportation has declined for the fear of infection transmission, private vehicles have become preferred. Many dealers were quick to adapt to online methods in reaching out to customers, enabling online walkthroughs and product delivery to customers’ homes (Forrester, 2020). Overall, however, sales have remained low. The electric vehicle market has had a different experience, though. New registrations for electric cars were more than their ICE counterparts during the lockdown period. The finding that lockdowns have done much to reduce CO2emissions has led some to reflect on the desirability of traditional vehicles from an environmental perspective. This, as some analysts say, could make electric cars more preferable to a section of buyers over gasoline or diesel powered vehicles. But the overall electric vehicle trend will depend on Government initiatives to promote them.

The woes of the auto industry were relieved to some extent when governments in some countries announced recovery packages for vehicle manufacturers. By July, as restrictions started easing, manufacturing resumed but sales did not recover to pre-COVID levels. A notable exception, however, is China, where there has been a rapid recovery in the automobile sector (Madhok, 2020). Worldwide, consumer confidence continues to remain low from the economic setback suffered. Amid all of this business, Tesla’s stock prices rose, so much so that it surpassed Toyota to become the most valuable automotive company in the world (“Tesla overtakes,” 2020).

Eyeing a steady recovery, manufacturers expect governments to ease emission restrictions but this is an option not every government is comfortable with. For instance, it is less likely for certain European countries that have been pushing for incentivizing the adoption of electric vehicles for a long time to ease emission laws (Hausler, 2020). To encourage people to purchase vehicles, companies and banks have slashed interest rates. For instance, the Reserve Bank of India brought down interest rates on vehicles and increased moratorium on loans by three months. In a similar move, the Bank of Canada slashed interest rates by 1.5% (Subramanian, 2020). Across various markets, sellers have been offering discounts and lower interest rates to attract buyers.

A few of the changes which were a result of the pandemic might stay. To regain steady sales figures, manufacturers and dealers have to be creative, flexible and innovative in their approaches. As people are increasingly embracing digitization, sellers may, in the coming months push for a major online sales drive. Also, seamless digitization may become a viable strategy for companies to capture market share in coming years. The drive for digitization may extend to providing better digital accessibility and integration of tech from vehicles’ on-screen controls and such digitization could extend to even touch-less gas station payments and maintenance (Wayland, 2020). Apart from these changes, companies and dealerships will likely continue providing the incentives on reduced interest rates, discounts and other offers to give potential buyers more reasons to buy vehicles at this time. This could also be an opportunity to increase research on autonomous vehicles as people practice social distancing. In addition, automobile industries should improve and invest in supply chains, using machine learning tools (Li et al., 2020) and big data analysis which will ensure that the efficiency of supply chains does not suffer and that total disruptions like the one due to COVID-19 can be controlled and production can be revived quickly (Ivanov and Dolgui, 2020).

Although R&D stalled during this period, the lessons learnt from the pandemic will pave the way for new ideas and research that could set new standards in the industry for the years to come. Together with integrated digitization, rising interest in electric vehicles and work-from-home standards, the future could bring systemic changes to the existing supply chain model and the industry as a whole.

References

[1] Madhok, A. (2020, September 15). Weekly Update: COVID-19 Impact On Global Automotive Industry. Counterpoint Research. https://www.counterpointresearch.com/weekly-updates-covid-19-impact-global-automotive-industry/

[2] Hausler, S., Heineke, K., Hensley, R., Möller, T., Schwedhelm, D., Shen, P. (2020, May 4) The impact of COVID-19 on future mobility solutions. McKinsey & Company. https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-impact-of-covid-19-on-future-mobility-solutions#:~:text=Over%20the%20long%20term%2C%20COVID,players%20will%20differ%20by%20location.

[3]Wayland, M. (2020, May 21). The coronavirus pandemic has upended auto sales and buying a car will never be the same. CNBC. https://www.cnbc.com/2020/05/21/the-coronavirus-pandemic-has-upended-auto-sales-and-buying-a-car-will-never-be-the-same.html

[4] (2020, July 1). Tesla overtakes Toyota to become world’s most valuable carmaker. BBC News. https://www.bbc.com/news/business-53257933

[5] Forrester, R., Toriello, M. (2020, September 28).Car dealers must become technology companies: An interview with the CEO of Vertu Motors . McKinsey & Company. https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/car-dealers-must-become-technology-companies-an-interview-with-the-ceo-of-vertu-motors

[6]Walker, A. (2020, April 20). US oil prices turn negative as demand dries up. BBC News. https://www.bbc.com/news/business-52350082

[7] Subramanian, H. (2020, May 7). Will car interest rates go down because of COVID-19? Lowestrates. https://www.lowestrates.ca/blog/auto/will-car-loan-interest-rates-go-down-covid-19

[8] Ivanov, D., Dolgui, A., et al. (2020). Viability of intertwined supply networks: extending the supply chain resilience angles towards survivability. A position paper motivated by COVID-19 outbreak. International Journal of Production Research. https://doi.org/10.1080/00207543.2020.1750727

[9] Li, X., Wang, B., Liu, C., et al. (2020). Intelligent Manufacturing Systems in COVID-19 Pandemic and Beyond: Framework and Impact Assessment. Chinese Journal of Mechanical Engineering. https://doi.org/10.1186/s10033-020-00476-w.

[10]Mordecai, M., Schumacher, S. (2020, September 14). In many countries, people are more negative about the economy amid COVID-19 than during Great Recession. Factank. https://www.pewresearch.org/fact-tank/2020/09/14/in-many-countries-people-are-more-negative-about-the-economy-amid-covid-19-than-during-great-recession/