Forum

Global Health Innovation

Center for Global Development

Broadcast on C-SPANPolitico, August 9, 2024.

Abstract: The Center for Global Development in Washington, DC hosted a day-long forum on accelerating innovation for climate and pandemic preparedness. In this portion of the event, White House official Stephanie Psaki discussed how innovation in global health security can be most effective. Also, a panel of judges (introduced by Christopher Snyder) heard a pitch from a finalist competing in University of Chicago’s Market Shaping Accelerator innovation competition, who proposed a solution for mitigating future pandemics.

Interview

5 questions for Christopher Snyder

By Derek Robertson

Politico, August 9, 2024.

Abstract: Interview with Dartmouth University economics professor Christopher Snyder, co-director of the University of Chicago’s Market Shaping Accelerator, which aims to create market incentives to solve social problems like climate change and pandemics and plans to dole out $2 million in awards to economists and entrepreneurs who propose those solutions...."

Podcast

How to Shape a Market

By Santi Ruiz

June 12, 2024.

Abstract: Dartmouth professor Christopher Snyder talks about his work on an advance market commitment for a pneumococcal vaccine, which has saved an estimated 700,000 lives. The interview will also cover his more recent work starting the University of Chicago's Market Shaping Accelerator.

Interview

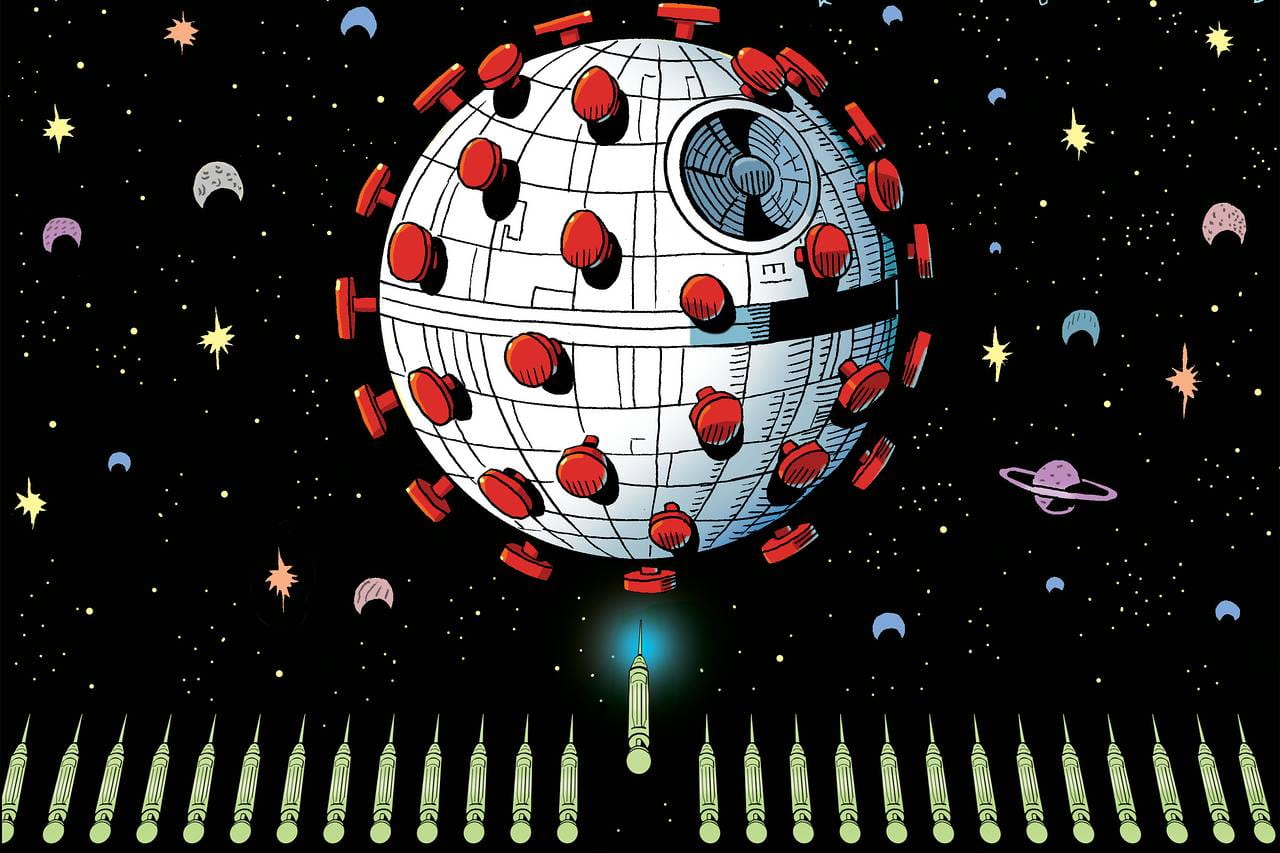

How Fractional Doses of COVID-19 Vaccines Could Boost Global Supply by Half a Billion Doses per Month

By Mitch Wertlieb

March 31, 2024.

Abstract: A group of the nation's leading economists published findings last month about how fractional doses of COVID vaccines could dramatically accelerate global vaccination rates by roughly half a billion doses per month. Clinical evidence suggests that these smaller doses could also be highly effective against hospitalizations and severe disease resulting from COVID-19.

Podcast

Creating and Shaping a Market for Carbon Removal

By Liana Frey

Dare to Green podcast, March 11, 2024.

Abstract: Chris Snyder and Nan Ransohoff talk about the Frontier advance market commitment, shaping the market for carbon removal.

Interview

The Frontier of Scientific Plausibility

By Tim Hwang

Macroscience article, August 25, 23.

Abstract: "When it came to the then-untested idea of doing mRNA vaccines, multiple scientists and industry insiders asserted that any modeling would be wildly miscalibrated if the probability of success was anything more than zero. When it came to the then-untested idea of doing mRNA vaccines, multiple industry insiders asserted that any modeling would be wildly miscalibrated if the probability of success was anything more than zero. For Chris, the reason economists did not ultimately assign a zero chance of success in their modeling was because they held a deeply ingrained assumption of the elasticity of the world. Simply put, you stick more money in, and more things come out."

Op-ed

How the Government Can Pay for a Universal Coronavirus Vaccine

By Rachel Glennerster, Thomas Kelly, and Christopher Snyder

The Hill, June 17, 2023

Abstract: We need a universal coronavirus vaccine to prevent future economic disaster and protect our communities. A type of contract called an advance market commitment can help accelerate its development in a cost-effective way.

Podcast

Episode #3 Big Green Economics Podcast

By Gabe Gottesman

Macroscience article, April 14, 2023.

Abstract: Christopher Snyder discusses his research on the economics of preparing for the next global pandemic using data from COVID-19 and analysis of optimal vaccine development.

Op-ed

Advance Market Commitments Worked for Vaccines. They Could Work for Carbon Removal, Too

By Susan Athey, Rachel Glennerster, Nan Ransohoff, and Christopher Snyder

Politico, December 22, 2022.

Abstract: Advance market commitments can incentivize the development of transformative carbon removal approaches.

Blog post

Discussing the Design of Advance Market Commitments for New Vaccines

By Michael Kremer, Jonathan Levin, and Christopher Snyder

Management Science Review blog, September 29, 2022.

Abstract: Provides an accessible discussion of companion paper in Management Science providing theoretical underpinnings of advance market commitments.

Op-ed

Bigger Is Better When It Comes to Vaccine Production

By Eric Budish and Christopher Snyder

Wall Street Journal, March 17, 2021.

Abstract: Churning out more doses may be expensive, but speeding up inoculations would be worth trillions.

Interview

The Benefits of Accelerated Vaccine Development "Are Bigger Than We Can Wrap Our Minds Around"

By Elias Papaioannou

London Business School COVID-19 Series, May 20, 2020.

Abstract: How can funding be structured to incentivize the rapid production of a vaccine for coronavirus? Elias Papaioannou, Professor of Economics at London Business School and Academic Director of the Wheeler Institute for Business and Development was joined in conversation with Christopher Snyder to discuss how an advanced market commitment could help speed the development of a vaccine for COVID-19.

Blog coverage

Accelerating HT

By Alex Tabarrok

Marginal Revolution, May 20, 2020.

Abstract: Describes work by Michael Kremer's Accelerating Health Technologies team, designing incentives to speed vaccines and other health technologies. Links to website, slides, and app providing calculations behind their global plan.

Op-ed

In the Race for a Coronavirus Vaccine, We Must Go Big. Really, Really Big

By Susan Athey, Michael Kremer, Christopher Snyder, and Alex Tabarrok

New York Times, May 4, 2020.

Abstract: An advance market commitment to support vaccine development is a critical component of a timely plan to defeat the virus, reopen the economy and return to normal life stronger and more resilient.

- Online article

- Coverage in Marginal Revolution blog

- Additional coverage in Marginal Revolution

- Coverage in Al Roth's Market Design blog

- Coverage by Matthew Yglesias in Vox ("Experts 7 Best Ideas on How to Beat Covid-19 and Save the Economy")

- Coverage by Ann Usher in The Lancet ("COVID-19 Vaccines for All?")

Research profile

Price Guarantee Spurred Vaccine Development for Poor Nations

By Lauri Scherer

NBER Digest, April 1, 2020.

Abstract: Reviews "Advance Market Commitments: Insights from Theory and Experience" by Michael Kremer, Jonathan Levin, and Christopher Snyder, discussing the economic logic behind advance market commitments and describing the pilot supporting the development and distribution of an important new vaccine, estimated to have saved 700,000 children's lives in low-income countries.

Column

Using Global Demand Calibrations to Evaluate Policy: Case Study of HIV Pharmaceuticals

By Fanele Mashwama, Christopher Snyder, and Michael Kremer

VoxEU, May 10, 2019.

Abstract: Consumers pay more for many pharmaceuticals in the US than in most other countries. This column investigates the welfare implications of such price discrimination using demand curves for HIV pharmaceuticals. A ban on price discrimination exacerbates the potentially large deadweight loss in the market for either a drug or a vaccine. However, this loss is ameliorated by a small government subsidy.

Column

Worst-case Deadweight Loss: Theory and Disturbing Real-world Implications

By Michael Kremer, Christopher Snyder, and Albert Chen

VoxEU, March 26, 2019.

Abstract: The deadweight loss from a monopolist’s not producing at all can be much greater than from charging too high a price. The column argues that the potential for this sort of deadweight loss is greatest when the market demand curve has a particular (Zipf) shape. Calibrations based on the world distribution of income generate this shape, with disturbing consequences for potential deadweight loss in global markets.

Column

What Economists Study: A guide for the Curious

By Christopher Snyder

VoxEU, August 12, 2017.

Abstract: With the press continuing to cast economics in a negative light, it is worth rethinking how our field is described to a lay audience. This column argues that even elementary principles can surprise non-economists with their power to explain a broader set of questions than most would think possible.

Column

Vaccines, Drugs, and Zipf Distributions

By Michael Kremer, Christopher Snyder, and Natalia Drozdoff

VoxEU, January 29, 2016.

Abstract: Many observers believe that pharmaceutical firms prefer to invest in drugs to treat diseases rather than vaccines. This column presents an economic rationale for why such a pattern may emerge for diseases like HIV/AIDS. The population risk of such diseases resembles a Zipf distribution, which makes the shape of the demand curve for a drug more conducive to revenue extraction than for a vaccine. Based on revenue calibrations using US data on HIV risk, the revenue from a drug is about four times greater.