Examining Selection Pressures in the Publication Process Through the Lens of Sniff Tests

With Ran Zhuo

Review of Economics and Statistics, forthcoming.

Abstract: The increasing demand for empirical rigor has led to the growing use of auxiliary tests (balance, pre-trends, over-identification, placebo, etc.) to help assess the credibility of a paper’s main results. We dub these “sniff tests” because rejection is bad news for the author and standards for passing are informal. We use these sniff tests—a sample of nearly 30,000 hand collected from scores of economics journals—as a lens to examine selection pressures in the publication process. We derive bounds under plausible nonparametric assumptions on the latent proportion of significant sniff tests removed by the publication process (whether by p-hacking or relegation to the file drawer) and the proportion whose significance was due to true misspecification, not bad luck. For the subsample of balance tests in randomized controlled trials, we find that the publication process removed at least 30% of significant p-values. For the subsample of other tests, we find a that at least 40% of significant p-values indicated true misspecification. We use textual analysis to assess whether authors over-attribute significant sniff tests to bad luck.

- Article PDF

- Early version in NBER working paper no. 25058 (first revision)

Optimal Vaccine Subsidies for Epidemic Diseases

With Matthew Goodkin-Gold, Michael Kremer, and Heidi Williams

Review of Economics and Statistics, forthcoming.

Abstract: We analyze optimal vaccine subsidies in a model integrating disease epidemiology into a market with rational economic agents. The focus is on an intensive vaccine campaign to quell an epidemic in the short run. Across a range of market structures, positive vaccine externalities and optimal subsidies peak for diseases that spread quickly, but not so quickly that everyone is driven to be vaccinated. We assess the practical relevance of this peak---as well as the existence of increasing social returns to vaccination and optimality of universal vaccination---in calibrations to the Covid-19 pandemic.

- Working paper version

- Online appendixes

- Matlab code for figures

- Matlab code for Covid-19 calibration

- Second of two companion papers derived from longer NBER working paper no. 28085

Calculating the Costs and Benefits of Advance Preparations for Future Pandemics

With Rachel Glennerster and Brandon Tan

IMF Economic Review, September 2023, 71 (3): 611-648..

Abstract: While Covid-19 vaccines were developed and deployed with unprecedented speed, their widespread introduction could have been accelerated—saving millions of lives and trillions of dollars—had more vaccine capacity been available prior to the pandemic. Combining estimates of the frequency and intensity of pandemics with estimates of mortality, economic-output, and human-capital losses from pandemics of varying severities, we calculate that the present value of global social losses from the stream of future pandemics can be expected to be nearly $18 trillion—over $700 billion each year going forward. According to our model, a program spending $60 billion up front to expand production capacity and supply-chain inputs for vaccines and $5 billion annually thereafter would be sufficient to ensure production capacity to vaccinate 70% of the global population against a new virus within six months. The program would generate an expected net present value (NPV) gain of more than $500 billion over the status quo of delaying investment until a pandemic arrives. A program undertaken by the United States alone would generate an expected NPV gain of over $60 billion.

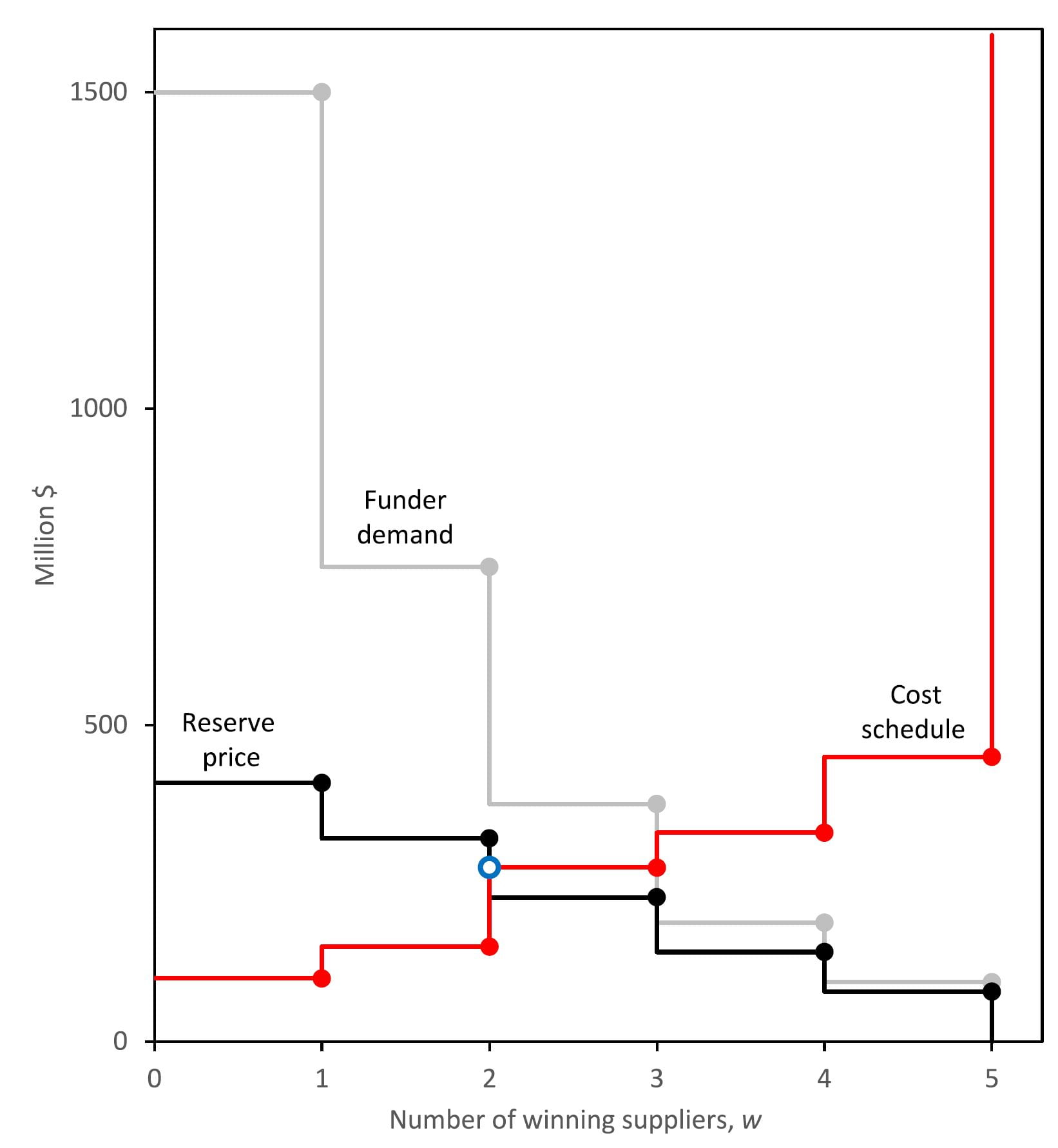

An Optimal Mechanism to Fund the Development of Vaccines Against Emerging Epidemics

With Kendall Hoyt and Dimitrios Gouglas

Journal of Health Economics, September 2023, 91 (102795): 1-25.

Abstract: We derive the optimal funding mechanism to incentivize development and production of vaccines against diseases with epidemic potential. In the model, suppliers' costs are private information and investments are noncontractible, precluding cost-reimbursement contracts, requiring fixed-price contracts conditioned on delivery of a successful product. The high failure risk for individual vaccines calls for incentivizing multiple entrants, accomplished by the optimal mechanism, a w+1 price reverse Vickrey auction with reserve, where w is the number of selected entrants. Our analysis determines the optimal number of entrants and required funding level. Based on a distribution of supplier costs estimated from survey data, we simulate the optimal mechanism's performance in scenarios ranging from a small outbreak, causing harm in the millions of dollars, to the Covid-19 pandemic, causing harm in the trillions. We assess which mechanism features contribute most to its optimality.

How the Government Can Pay for a Universal Coronavirus Vaccine

With Rachel Glennerster and Thomas Kelly

The Hill, June 17, 2023

Abstract: We need a universal coronavirus vaccine to prevent future economic disaster and protect our communities. A type of contract called an advance market commitment can help accelerate its development in a cost-effective way.

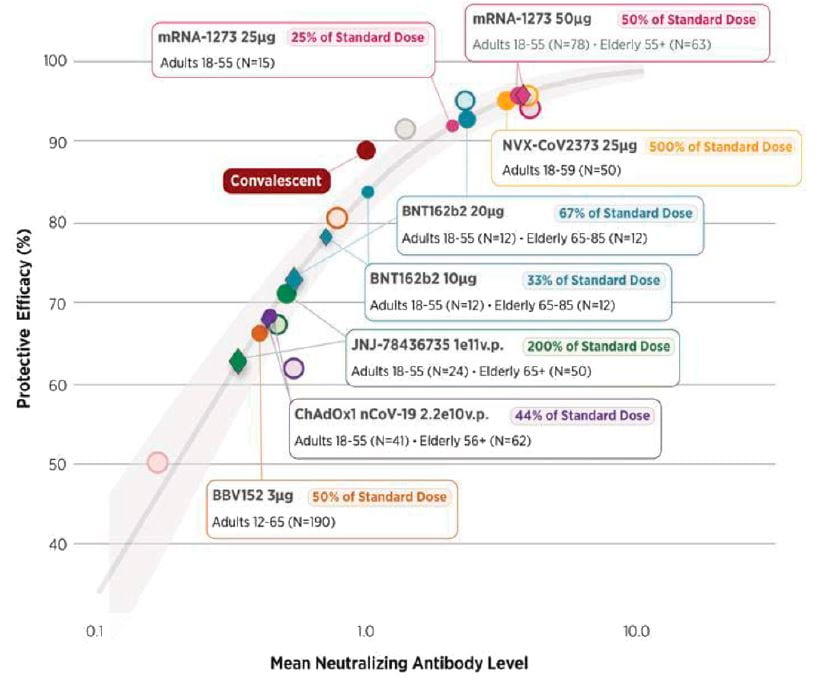

Expanding Capacity for Vaccines Against Covid-19 and Future Pandemics: A Review of Economic Issues

With Susan Athey, Juan Camilo Castillo, Esha Chaudhuri, Michael Kremer, and Alexandre Simoes Gomes

Oxford Review of Economics and Policy, Winter 2022, 38 (4): 742-770. Lead article in special issue on Economics of Pandemic Vaccination.

Abstract: We review economic arguments for using public policy to accelerate vaccine supply during a pandemic. Rapidly vaccinating a large share of the global population helps avoid economic, mortality, and social losses, which in the case of Covid-19 mounted into trillions of dollars. However, pharmaceutical firms are unlikely to have private incentives to invest in vaccine capacity at the socially optimal scale and speed. The socially optimal level of public spending may cause some sticker shock but—as epitomized by the tagline “spending billions to save trillions”—is eclipsed by the benefits and can be restrained with the help of careful policy design and advance preparations. Capacity is so valuable during a pandemic that fractional dosing and other measures to stretch available capacity should be explored.

- Abstract with link to published article (available open access)

- PDF of published article

- NBER working paper no. 30192

Optimal Vaccine Subsidies for Endemic Diseases

With Matthew Goodkin-Gold, Michael Kremer, and Heidi Williams

International Journal of Industrial Organization, September 2022, 102840.

Abstract: Our previous work (Goodkin-Gold et al. 2022, "Optimal Vaccine Subsidies for Epidemic Diseases") analyzes optimal subsidies for a vaccine against an epidemic outbreak like Covid-19. This companion paper alters the underlying epidemiological model to suit endemic diseases requiring continuous vaccination of new cohorts—also suiting an epidemic like Covid-19 if, following Gans (2020), one assumes peaks are leveled by social distancing. We obtain qualitatively similar results: across market structures ranging from perfect competition to monopoly, the subsidy needed to induce first-best vaccination coverage on the private market is highest for moderately infectious diseases, which invite the most free riding; extremely infectious diseases drive more consumers to become vaccinated, attenuating externalities. Stylized calibrations to HIV, among other diseases, suggest that first-best subsidies can be exorbitantly high when suppliers have market power, rationalizing alternative policies observed in practice such as bulk purchases negotiated by the government on behalf of the consumers.

- Abstract with link to published article (available open access)

- First of two companion papers derived from NBER working paper no. 28085

Designing Advance Market Commitments for New Vaccines

With Jonathan Levin and Michael Kremer

Management Science, July 2022, 68 (7): 4786-4814. Featured article.

Abstract: Advance market commitments (AMCs) provide a mechanism to stimulate investment by suppliers of products to low-income countries. In an AMC, donors commit to a fund from which a specified subsidy is paid per unit purchased by low-income countries until the fund is exhausted, strengthening suppliers' incentives to invest in research, development, and capacity. Last decade saw the launch of a $1.5 billion pilot AMC to distribute pneumococcal vaccine to the developing world; in the current pandemic, variations on AMCs are being used to fund Covid-19 vaccines.

This paper undertakes the first formal analysis of AMCs. We construct a model in which an altruistic donor negotiates on behalf of a low-income country with a vaccine supplier after the supplier has sunk investments. We use this model to explain the logic of an AMC—as a solution to a hold-up problem—and to analyze alternative design features under various economic conditions (cost uncertainty, supplier competition). A key finding is that optimal AMC design differs markedly depending on where the product is in its development cycle.

- Abstract with link to published article (available open access)

- Featured-article coverage in Management Science review blog

- NBER working paper no. 28168

- Bloomberg coverage

- Coverage by Al Roth's "Market Design" blog

Testing Fractional Doses of COVID-19 Vaccines

With Witold Wiecek, Amrita Ahuja, Esha Chaudhuri, Michael Kremer, Alexandre Simoes Gomes, Alex Tabarrok, and Brandon Tan

Proceedings of the National Academy of Sciences, February 2022, 119 (8): 1-8.

Abstract: Switching to fractional doses could dramatically accelerate vaccination, and clinical evidence suggests that fractional doses of COVID-19 vaccines could be highly effective. However, there is uncertainty about the effectiveness of fractional doses. In this paper, we present the existing evidence and use epidemiological models to quantify benefits under various scenarios. We argue for more experimental or observational data to be collected urgently. Because switching to fractional dosing could dramatically accelerate vaccination, the potential benefits of further testing of fractional doses far outweigh the costs.

- Abstract with link to published article (available open access)

- NBER working paper no. 29018

- Coverage on Vermont Public Radio "Morning Edition"

- Coverage in "Marginal Revolution" blog

Opinion: Advance Market Commitments Worked for Vaccines. They Could Work for Carbon Removal, Too

With Susan Athey, Rachel Glennerster, and Nan Ransohoff

Politico, op-ed, December 22, 2022.

Abstract: Through “advance market commitments,” we can incentivize the development of transformative carbon removal approaches.

Cite Unseen: Theory and Evidence on the Effect of Open Accesson Cites to Academic Articles Across the Quality Spectrum

With Mark McCabe

Managerial and Decision Economics, December 2021, 42 (8): 1960-1979.

Abstract: We model open access as facilitating full-text acquisition, which, while often increasing cites, can reduce cites from readers who refrain from citing superficially after realizing the article is not worth citing. We test the theory with data on over 200,000 science articles binned by cites in the pre-study period. Consistent with theory, we find that opening access to an article on the journal's website has a "Matthew effect" on citations: negative for the least-cited articles, positive for the most cited, and monotonic for quality levels in between. Estimates for broader open-access platforms and for cites coming from insiders versus outsiders also follow patterns consistent with theory.

- Abstract with link to published article

- Online Appendixes S1 and S2 containing supplementary material

- Pre-print of published article

- NBER working paper no. 28128

- Coverage in Science article

A Simple Method for Bounding the Elasticity of Growing Demand with Applications to the Analysis of Historic Antitrust Cases

With Wallace Mullin

American Economic Journal: Microeconomics, November 2021, 13 (4): 172-217.

Abstract: We propose a simple method, requiring only minimal data, for bounding demand elasticities in growing, homogeneous-product markets. Since growing demand curves cannot cross, shifts in market equilibrium over time can be used to "funnel" the demand curve into a narrow region, bounding its slope. Our featured application assesses the antitrust remedy in the 1952 DuPont decision, ordering incumbents to license patents for commercial plastics. We bound the demand elasticity significantly below 1 in many post-remedy years, inconsistent with monopoly, supporting the remedy's effectiveness. A second application investigates whether the 1911 dissolution of American Tobacco fostered competition in the cigarette market.

- Abstract with link to online article

- Pre-print of published article

- Online appendix D containing supplementary materials

- NBER Working Paper no. 24786

- Stata code to apply methods to user-supplied data assuming (a) linear demand, (b) logit demand

- R code to apply methods to user-supplied data assuming linear demand

- Additional code used in paper available on Open ICPSR archive 116767

- Excel data: (a) U.S. polyethylene market 1958-72, (b) U.S. cigarette market 1913-28

Preparing for a Pandemic: Accelerating Vaccine Availability

With Amrita Ahuja, Susan Athey, Arthur Baker, Eric Budish, Juan Camilo Castillo, Rachel Glennerster, Scott Kominers, Michael Kremer, Jean Lee, Canice Prendergast, Alex Tabarrok, Brandon Tan, and Witold Wiecek

American Economic Association Papers and Proceedings, May 2021, 111: 331-335.

Abstract: Vaccinating the world’s population quickly in a pandemic has enormous health and economic benefits. We analyze the problem faced by governments in determining the scale and structure of procurement for vaccines. We analyze alternative approaches to procurement. We find that if the goal is to accelerate the vaccine delivery timetable, buyers should directly fund manufacturing capacity and shoulder most of the risk of failure, while maintaining some direct incentives for speed. We analyzed the optimal portfolio of vaccine investments for countries with different characteristics as well as the implications for international cooperation. Our analysis, considered in light of the experience of 2020, suggests lessons for future pandemics.

- Abstract with link to online copy (available open access)

- Pre-print of published article

- Online appendix

- NBER Working Paper no. 28492

- Coverage in Al Roth's "Market Design" blog

Market Design to Accelerate COVID-19 Vaccine Supply

With Juan Camilo Castillo, Amrita Ahuja, Susan Athey, Arthur Baker, Eric Budish, Tasneem Chipty, Rachel Glennerster, Scott Kominers, Michael Kremer, Greg Larson, Jean Lee, Canice Prendergast, Alex Tabarrok, Brandon Tan, and Witold Wiecek

Science, March 2021, 371 (6534): 1107-1109.

Abstract: We estimate that installed capacity for 3 billion annual vaccine courses has a global benefit of $17.4 trillion, over $5,800 per course. Investing now in expanding capacity for an additional annual 1 billion courses could accelerate completion of widespread immunization by over 4 months, providing additional global benefits of over $500 per course. This eclipses prices of $6 to $40 per course seen in deals with vaccine producers, indicating the wide gap between social and commercial incentives. We urge governments and international organizations to contract with vaccine producers to further expand capacity and encourage measures described below to "stretch" existing capacity (such as lower-dose regimens) and efficiently allocate courses (such as a cross-country vaccine exchange).

- Abstract with link to online copy (available open access)

- Pre-print of published article

- Supplementary materials: online appendix

- Coverage in The Economist

- Coverage in "Marginal Revolution" blog

Opinion: Bigger Is Better When It Comes to Vaccine Production

With Eric Budish

Wall Street Journal, op-ed, March 17, 2021.

Abstract: Churning out more doses may be expensive, but speeding up inoculations would be worth trillions.

Estimates of ACO Savings in the Presence of Provider and Beneficiary Selection

With Mariétou Ouayogodé, Ellen Meara, Kate Ho, and Carrie Colla

Healthcare, March 2021, 9 (1): 1-9.

Abstract: Medicare's accountable care organizations (ACOs)—designed to improve quality and lower spending—were associated with growing savings in previous studies. Using Medicare administrative claims (2009–2014), we compared annual spending changes after providers joined ACOs compared to non-ACO controls. We took a suite of measures to control for provider and beneficiary selection. Starting from a baseline regression modeled on previous ACO evaluations, estimated savings varied widely as we sequentially introduced methods to address selection. Combining methods, however, generated more stable estimated ACO savings, a modest $46 averaged across cohorts.

Strengthening Incentives for Vaccine Development

With Michael Kremer

December 2020, NBER Reporter.

Designing Pull Funding For A COVID-19 Vaccine

With Kendall Hoyt, Dimitrios Gouglas, Thomas Johnston, and James Robinson

Health Affairs, September 2020, 39 (9): 1633-1642.

Abstract: A widely accessible vaccine is essential to mitigate the health and economic ravages of Covid-19. Without appropriate incentives and coordination, however, firms might not respond at sufficient speed or scale, and competition among countries for limited supply could drive up prices and undercut efficient allocation. Programs relying on "push" incentives (direct cost reimbursement) can be complicated by the funder’s inability to observe firms’ private cost information. To address these challenges, we propose a "pull" program that incentivizes late-stage development (Phase III trials and manufacturing) for COVID-19 vaccines by awarding advance purchase agreements to bidding firms. Using novel cost and demand data, we calculated the optimal size and number of awards. In baseline simulations, the optimal program induced the participation of virtually all ten viable vaccine candidates, spending an average of $110 billion to generate net benefits of $2.8 trillion—nearly double the net benefits generated by the free market.

- Abstract with link to published article

- Pre-print of published article

- Online appendix containing supplementary materials

Opinion: In the Race for a Coronavirus Vaccine, We Must Go Big. Really, Really Big

With Susan Athey, Michael Kremer, and Alex Tabarrok

New York Times, op-ed, May 4, 2020.

Abstract: An advance market commitment to support vaccine development is a critical component of a timely plan to defeat the virus, reopen the economy and return to normal life stronger and more resilient.

- Online article

- Coverage in "Marginal Revolution" blog

- Additional coverage in "Marginal Revolution"

- Coverage in Al Roth's "Market Design" blog

- Coverage by Matthew Yglesias in Vox ("Experts 7 Best Ideas on How to Beat Covid-19 and Save the Economy")

Advance Market Commitments: Insights from Theory and Experience

With Michael Kremer and Jonathan Levin

American Economic Association Papers and Proceedings, May 2020, 110: 269-267.

Abstract: Ten years ago, donors committed $1.5 billion to a pilot advance market commitment (AMC) to help purchase pneumococcal vaccine for low-income countries. The AMC aimed to encourage the development of such vaccines, ensure distribution to children in low-income countries, and pilot the AMC mechanism for possible future use. Three vaccines have been developed and more than 150 million children immunized, saving an estimated 700,000 lives. This paper reviews the economic logic behind AMCs, the experience with the pilot, and key issues for future AMCs.

- Abstract with link to published article

- Pre-print of published article

- Online appendix containing supplementary materials

- Coverage in NBER Digest

Preventives versus Treatments Redux: Tighter Bounds on Distortions in Innovation Incentives with an Application to the Global Demand for HIV Pharmaceuticals

With Michael Kremer

Review of Industrial Organization, August 2018, 53 (1): 235-273.

Abstract: Kremer and Snyder (Quarterly Journal of Economics 2015) show that demand curves for a preventive and treatment may have different shapes though they target the same disease, biasing the pharmaceutical manufacturer toward developing the lucrative rather than the socially desirable product. This paper tightens the theoretical bounds on the potential deadweight loss from such biases. Using a calibration of the global demand for HIV pharmaceuticals, we demonstrate the dramatically sharper analysis achievable with the new bounds, allowing us to pinpoint potential deadweight loss at 62% of the global gain from curing HIV. We use the calibration to perform policy counterfactuals, assessing welfare effects of government policies such as a subsidy, reference pricing, and price discrimination ban. The fit of our calibration is good: we find that a hypothetical drug monopolist would price an HIV drug so high that only 4% of the infected population worldwide would purchase, matching actual drug prices and quantities in the early 2000s before subsidies in low-income countries ramped up.

- Abstract with link to online article

- Pre-print of published article

- NBER working paper no. 24206

- Related VoxEU article "Using Global Demand Calibrations to Evaluate Policy: Case Study of HIV Pharmaceuticals" (with Michael Kremer and Fanele Mashwama), May 2019

- Country data in Excel: GDP, Population, HIV prevalence

- Stata code for calibrations

Open Access as a Crude Solution to a Hold-Up Problem in the Two-Sided Market for Academic Journals

With Mark McCabe

Journal of Industrial Economics, June 2018, 66 (1): 301-349.

Abstract: We analyze a model in which journals cannot commit to subscription fees when authors (who prefer low subscription fees because this boosts readership) make submission decisions. A hold-up problem arises, manifested as excessive subscription fees. Open access is a crude attempt to avoid hold up by eliminating subscription fees. We assess the profitability and efficiency of traditional relative to open-access journals in a monopoly model (with extensions to nonprofit, bundled, hybrid, and competing journals). We apply the theory to understand the evolving market for academic journals in the Internet age and policies currently being debated such as an open-access mandate.

- Abstract with link to online article

- Pre-print of published article

- NBER working paper no. 22220

- Online appendixes (Appendix D: Further Proofs, Appendix E: Hybrid Pricing Strategy)

Communication in Vertical Markets: Experimental Evidence

With Claudia Moellers and Hans-Theo Normann

International Journal of Industrial Organization, January 2017, 50 (1): 214-258.

Abstract: An upstream monopolist supplying competing downstream firms may fail to monopolize the market because it is unable to commit not to behave opportunistically. We build on previous experimental studies of this well-known commitment problem by introducing communication. Allowing the upstream firm to chat privately with each downstream firm reduces total offered quantity from near the Cournot level (observed in the absence of communication) halfway toward the monopoly level. Allowing all firms to chat together openly results in complete monopolization. Downstream firms obtain such a bargaining advantage from open communication that all of the gains from monopolizing the market accrue to them. A simple structural model of Nash-in-Nash bargaining fits the pattern of shifting surpluses well. Using third-party coders, unsupervised text mining, among other approaches, we uncover features of the rich chat data that are correlated with market outcomes. We conclude with a discussion of the antitrust implications of open communication in vertical markets.

- Abstract with link to online article

- PDF copy of published article

- Online appendix (Appendix B: Instructions to Subjects)

What Is Economics?

In Dan Rockmore, ed., What Are the Arts and Sciences? A Guide for the Curious, University Press of New England, 2017.

- PDF copy of published chapter

- Related VoxEU article "What Economists Study: A Guide for the Curious," August 2017

Preventives Versus Treatments

With Michael Kremer

Quarterly Journal of Economics, August 2015, 130 (3): 1167-1239.

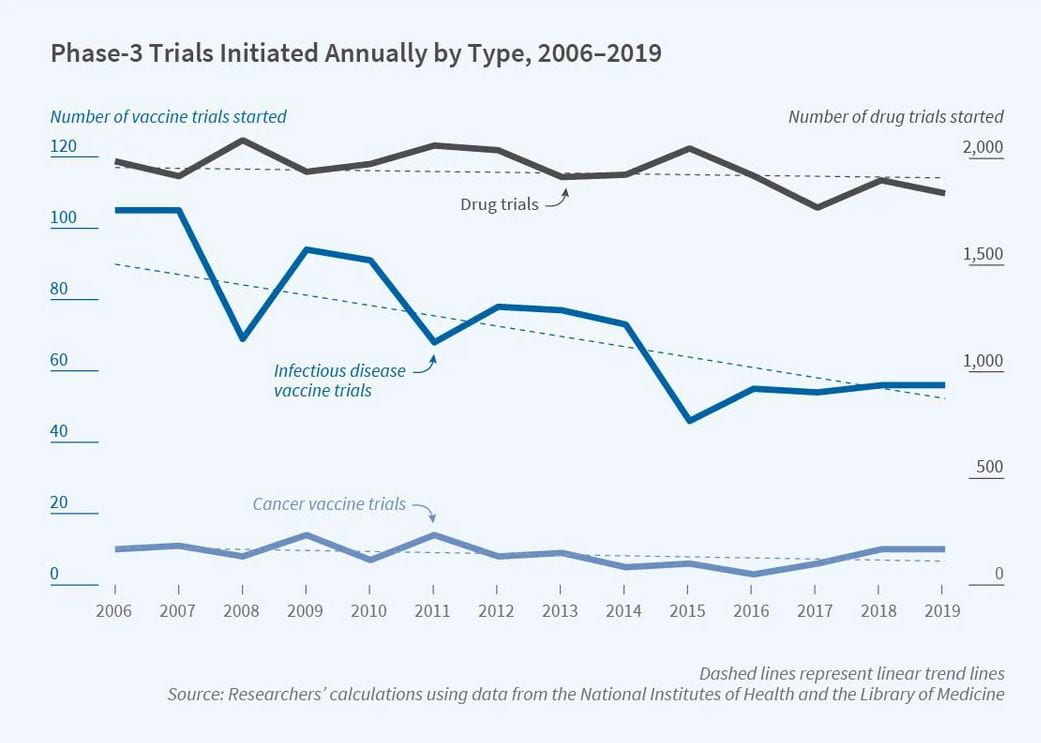

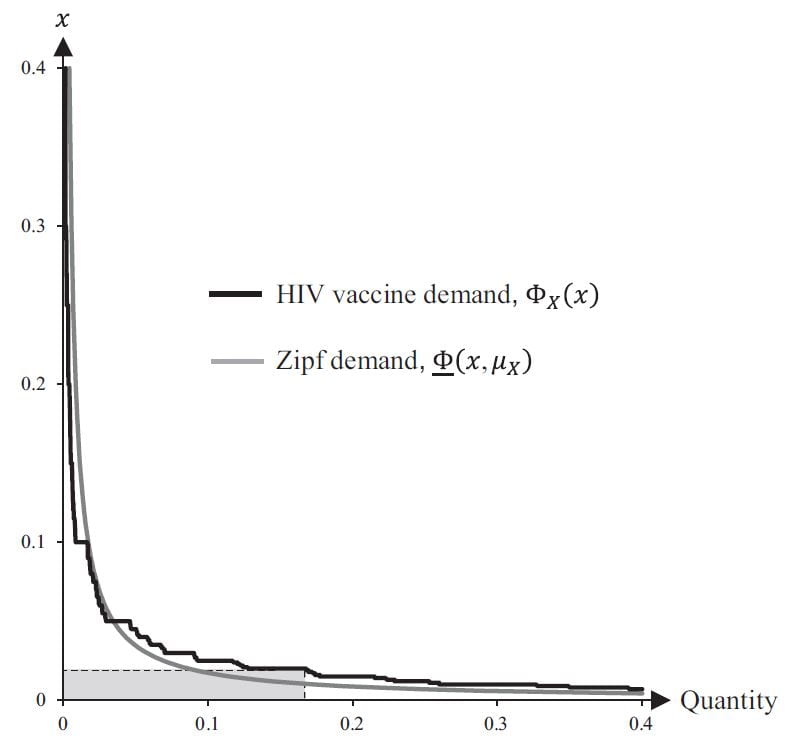

Abstract: Preventives are sold ex ante, before disease status is realized, while treatments are sold ex post. Even if the mean of the ex ante distribution of consumer values is the same as that ex post, the shape of the distributions may differ, generating a difference between the surplus each product can extract. If, for example, consumers differ only in ex ante disease risk, then a monopolist would have more difficulty extracting surplus with a preventive than with a treatment because treatment consumers, having contracted the disease, no longer differ in disease risk. We show that the ratio of preventive to treatment producer surplus can be arbitrarily small, in particular when the distribution of consumer values has a Zipf shape and the disease is rare. The firm’s bias toward treatments can be reversed, for example, if the source of private information is disease severity learned ex post. The difference between the producer surplus earned from the products can result in distorted R&D incentives; the deadweight loss from this distortion can be as large as the entire producer-surplus difference. Calibrations for HIV and heart attacks based on risk factors in the U.S. population suggest that the distribution of disease risk is sufficiently Zipf-similar to generate substantial differences between producer surplus from preventives and treatments. Empirically, we find that proxies for the Zipf-similarity of the disease-risk distribution are associated a significantly lower likelihood of vaccine development but not drug development.

- Abstract with link to online article

- PDF copy of published article

- Final NBER working paper no. 21012 (March 2015)

- Early NBER working paper no. 9833 (July 2003)

- Related VoxEU article "Vaccines, Drugs, and Zipf Distributions" (with Michael Kremer and Natalia Drozdoff), January 2016

Does Online Availability Increase Citations? Theory and Evidence from a Panel of Economics and Business Journals

With Mark McCabe

Review of Economics and Statistics, March 2015, 97 (1): 144-165.

Abstract: Does online availability boost citations? Using a panel of citations to economics and business journals, we show that the enormous effects found in previous studies were an artifact of their failure to control for article quality, disappearing once fixed effects are added as controls. The absence of aggregate effects masks heterogeneity across platforms: JSTOR has a uniquely large effect, boosting citations around 10%. We examine other sources of heterogeneity, including whether JSTOR disproportionately increases cites from developing countries or to "long-tail" articles. Our theoretical analysis informs the econometric specification and allows citation increases to be translated into welfare terms.

Identifying the Effect of Open Access on Citations Using a Panel of Science Journals

With Mark McCabe

Economic Inquiry, October 2014, 52 (4): 1284-1300.

Abstract: An open-access journal allows free online access to its articles, obtaining revenue from fees charged to submitting authors or from institutional support. Using panel data on science journals, we are able to circumvent problems plaguing previous studies of the impact of open access on citations. In contrast to the huge effects found in these previous studies, we find a more modest effect: moving from paid to open access increases cites by 8% on average in our sample. The benefit is concentrated among top-ranked journals. In fact, open access causes a statistically significant reduction in cites to the bottom-ranked journals in our sample, leading us to conjecture that open access may intensify competition among articles for readers' attention, generating losers as well as winners.

Open Access Versus Traditional Journal Pricing: Using a Simple 'Platform Market' Model to Understand Which Will Win (and Which Should)

With Mark McCabe and Anna Fagin

Journal of Academic Librarianship, January 2013, 39 (1): 11-19.

Abstract: Economists have built a theory to understand markets in which, rather than selling directly to buyers, suppliers sell through a platform, which controls prices on both sides. The theory has been applied to understand markets ranging from telephony, to credit cards, to media. In this paper, we apply the theory to the market for scholarly journals, with the journal functioning as the platform between submitting authors and subscribing readers. Our goal is to understand the conditions under which a journal would prefer open access to traditional pricing and under which open access would be better for the scholarly community. Our new model captures much of the richness of the existing economic literature on journal pricing, and indeed adds some fresh insights, yet is simple enough to be accessible to a broad audience.

Spending Differences Associated with the Medicare Physician Group Practice Demonstration

With Carrie Colla, David Wennberg, Ellen Meara, Jonathan Skinner, Daniel Gottlieb, Valerie Lewis, and Elliott Fisher

Journal of the American Medical Association, September 2012, 308 (10): 1015-1023.

Abstract: The Centers for Medicare & Medicaid Services recently launched accountable care organization (ACO) programs designed to improve quality and slow cost growth. The ACOs resemble an earlier pilot, the Medicare Physician Group Practice Demonstration (PGPD), in which participating physician groups received bonus payments if they achieved lower cost growth than local controls and met quality targets. Although evidence indicates the PGPD improved quality, uncertainty remains about its effect on costs. We conducted a quasi-experimental analyses, comparing preintervention (2001-2004) and postintervention (2005-2009) trends in spending of PGPD participants to local control groups. We compared estimates using several alternative approaches to adjust for case mix. We find that the substantial PGPD savings achieved by some participating institutions were offset by a lack of saving at other participating institutions. Most of the savings were concentrated among beneficiaries dually eligible for Medicare and Medicaid, an index of vulnerable patients.

- Abstract with link to online article

- PDF copy of published article

- Supplemental content

- JAMA editorial comment by Donald M. Berwick, "ACOs---Promise, Not Panacea"

- New York Times coverage

Economic Perspectives on the Advance Market Commitment for Pneumococcal Vaccines

With Wills Begor and Ernst Berndt

Health Affairs, August 2011, 30 (8): 1508-1517.

Abstract: Pharmaceutical companies have long been reluctant to invest in producing new vaccines for the developing world because they have little prospect of earning an attractive return. One way to stimulate such investment is the use of an advance market commitment, an innovative financing program that guarantees manufacturers a long-term market. Under this arrangement, international donors pay a premium for initial doses sold to developing countries. In exchange, companies agree to continue supplying the vaccine over the longer term at more sustainable prices. This article provides a preliminary economic analysis of a pilot advance market commitment program for pneumococcal vaccines, explaining the principles behind the program’s design and assessing its early performance. Spurred by the advance market commitment—and other contemporaneous initiatives that also increased resources to vaccine suppliers—new, second-generation pneumococcal vaccines have experienced a much more rapid rollout in developing countries than older first-generation vaccines.

- Abstract with link to online article

- PDF copy of published article

- Technical appendix

- Webcast of Health Affairs "Global Decade of Vaccines" press briefing

Should Firms be Allowed to Indemnify Their Employees for Sanctions?

With Wallace Mullin

Journal of Law, Economics, & Organization, April 2010, 26 (1): 30-53.

Abstract: Policymakers have questioned whether firms should be allowed to indemnify their employees for personal sanctions for corporate crimes. This article provides the first formal analysis of this form of indemnification. Targeting employees with unindemnifiable sanctions carries the social cost of exposing employees of law-abiding firms to the risk of mistaken government prosecution. Deterrence is typically achieved more efficiently by sanctioning the firm alone. We find the circumstances under which the government should additionally sanction employees to be quite limited and the circumstances under which the government should ban indemnification of these sanctions to be more limited still. One circumstance is when an unindemnifiable employee sanction provides prosecutors with leverage to adjust the employee's sanction in exchange for his cooperation against the firm.

Countervailing Power in Wholesale Pharmaceuticals

With Sara Fisher Ellison

Journal of Industrial Economics, March 2010, 58 (1): 32-53.

Abstract: Using data on wholesale prices for antibiotics sold to U.S. drugstores, we test the growing theoretical literature on 'countervailing power' (a term for the ability of large buyers to extract discounts from suppliers). Large drugstores receive a modest discount for antibiotics produced by competing suppliers but no discount for antibiotics produced by monopolists. These findings support theories suggesting that supplier competition is a prerequisite for countervailing power. As further evidence for the importance of supplier competition, we find that hospitals receive substantial discounts relative to drugstores, attributed to hospitals' greater ability to induce supplier competition through restrictive formularies.

Corporate Crime

With Wallace Mullin

Chapter 9 in N. Garoupa, ed., Encyclopedia of Law and Economics, Volume 3: Criminal Law and Economics, second edition, Edward Elgar, 2009.

Countervailing Power

In Steven. N. Durlauf and Lawrence E. Blume, eds., The New Palgrave Dictionary of Economics, second edition, Palgrave Macmillan, 2008.

Do Buyer-Size Discounts Depend on the Curvature of the Surplus Function? Experimental Tests of Bargaining Models

With Hans-Theo Normann and Bradley Ruffle

Rand Journal of Economics, Autumn 2007, 38 (3): 747-767.

Abstract: A number of recent theoretical papers have shown that, for buyer-size discounts to emerge in a bargaining model, the total surplus function over which parties bargain must have certain nonlinearities. We test the theory in an experimental setting in which a seller bargains with a number of buyers of different sizes. Nonlinearities in the surplus function are generated by varying the shape of the seller's cost function. Consistent with the theory, we find that quantity discounts emerge only in the case of increasing marginal cost, corresponding to a concave surplus function. We provide additional structural estimates to help identify the source of remaining discrepancies between experimental behavior and theoretical predictions (whether due to preferences for fairness or other factors such as computation errors).

The Identity of the Generator in the Problem of Social Cost

With Rohan Pitchford

Journal of Environmental Economics and Management July 2007, 54 (1): 49-67.

Abstract: One of Coase's central insights is that distinguishing between the generator and recipient of an externality is of limited value because externality problems are reciprocal. We reconsider the relevance of the identity of the generator in a model with non-contractible investment ex ante but frictionless bargaining over the externality ex post. In this framework, a party may distort its investment to worsen the other's threat point in bargaining. We demonstrate that the presence of this distortion depends, among other factors, on whether the investing party is a generator. Social efficiency can sometimes be improved by conditioning property rights on the identity of the generator: for example, assigning damage rights if the rights holder is a generator and injunction rights if the rights holder is a recipient can be more efficient than either unconditional damage or injunction rights.

Academic Journal Prices in a Digital Age: A Two-Sided-Market Model

With Mark McCabe

The B. E. Journal in Economic Analysis & Policy (Contributions), January 2007, 7 (1): article 2.

Abstract: Digital-age technologies promise to revolutionize the market for academic journals as they have other media. We model journals as intermediaries linking authors with readers in a two-sided market. We use the model to study the division of fees between authors and readers under various market structures, ranging from monopoly to free entry. The results help explain why print journals traditionally obtained most of their revenue from subscription fees. The results raise the possibility that digitization may lead to a proliferation of online journals targeting various author types. The paper contributes to the literature on two-sided markets in its analysis of free-entry equilibrium and modeling of product-quality certification.

Bounding the Relative Profitability of Price Discrimination

With David Malueg

International Journal of Industrial Organization, September 2006, 24 (2): 995-1011.

Abstract: We derive bounds on the ratio of a monopolist's profit from third-degree price discrimination to that from uniform pricing. If the monopolist serves N independent markets, demand is continuous, and the cost function is superadditive, then the profit ratio is bounded by N. A linear-demand example is provided coming arbitrarily close to this bound. We provide examples showing the profit ratio can be unboundedly large when marginal cost is decreasing, demand is discontinuous, or fixed cost is positive. If the monopolist has access to certain demand-rationing strategies under uniform pricing, we can bound the profit ratio even for discontinuous demand functions and multiproduct cost functions.

Bundling Negotiations: An Efficiency Rationale for Multiproject Contact in Research Joint Ventures

With Nicholas Vonortas

Journal of Economic Behavior and Organization, December 2005, 58 (4): 459-486.

Abstract: In the first part of this paper, we conduct an empirical analysis of all research joint ventures registered under the National Cooperative Research Act. We document the pervasiveness of multiproject contact, defined as groups of firms engaging in several research joint ventures together. In the second part of the paper, we develop a theoretical model providing a new rationale for multiproject contact. In the model, each project involves decisions that are the subject of negotiations among participants. The inefficiency associated with bargaining under asymmetric information can be mitigated if negotiations over several projects are combined.

Open Access and Academic Journal Quality

With Mark McCabe

American Economic Review Papers and Proceedings, May 2005, 95 (2): 453-458.

Abstract: The paper extends our previous theoretical analysis of the market for academic journals model to allow articles and journals to vary in quality. Journals’ quality differences emerge endogenously through the talent of their editors, where more talented editors can distinguish between good and bad articles with more precision. High-quality journals thus publish more good articles. In the model, we ask whether open access is expected to emerge at the high- or low-quality end of the journal spectrum and whether journals are expected to lower their quality standards in order to boost revenue from author fees.

The Influence of Expert Reviews on Consumer Demand for Experience Goods: A Case Study of Movie Critics

With David Reinstein

Journal of Industrial Economics, March 2005, 53 (1): 27-51.

Abstract: An inherent problem in measuring the influence of expert reviews on the demand for experience goods is that a correlation between good reviews and high demand may be spurious, induced by an underlying correlation with unobservable quality signals. Using the timing of the reviews by two popular movie critics, Siskel and Ebert, relative to opening weekend box office revenue, we apply a difference-in-differences approach to circumvent the problem of spurious correlation. After purging the spurious correlation, the measured influence effect is smaller though still detectable. Positive reviews have a particularly large influence on the demand for dramas and narrowly-released movies.

The Best Business Model for Scholarly Journals: An Economist's Perspective

With Mark McCabe

Nature Web Focus, July 16, 2004.

Dynamic Adjustment in the U.S. Higher Education Industry, 1955-1997

With John Kwoka

Review of Industrial Organization, June 2004, 24 (4): 355-378.

Abstract: We analyze how the number of higher education institutions responds to demand growth by applying a dynamic model to U.S. data over the period 1955-1997. We derive our dynamic, partial adjustment model from first principles under various assumptions about firm behavior, ranging from profit-maximization by Cournot firms to output-maximization by non-profit firms. Empirical estimates from this dynamic model suggest that the higher education industry does indeed respond to demand growth, but only moderately in the short run and little more in the long run. Certain segments within the overall industry exhibit much stronger responsiveness in the short and long run, in particular, public and 2-year schools.

A Solution to the Hold Up Problem Involving Gradual Investment

With Rohan Pitchford

Journal of Economic Theory, January 2004, 14 (1): 88-103.

Abstract: We consider a setting in which the buyer's ability to hold up a seller's investment is so severe that there is no investment in equilibrium of the static game typically analyzed. We show that there exists an equilibrium of a related dynamic game generating positive investment. The seller makes a sequence of gradually smaller investments, each repaid by the buyer under the threat of losing further seller investment. As modeled frictions converge to zero, the equilibrium outcome converges to the first best. We draw connections between our work and the growing literature on gradualism in public good contribution games and bargaining games.

Coming to the Nuisance: An Economic Analysis from an Incomplete Contracts Perspective

With Rohan Pitchford

Journal of Law, Economics, & Organization, Fall 2003, 19 (2): 491-516.

Abstract: We construct a model in which an investment opportunity arises for a first mover before it knows the identity of a second mover and in which joint location results in a negative externality. Contracts are inherently incomplete since the first mover cannot bargain over its ex ante investment decision with the anonymous second mover. Given this departure from the setting of the Coase theorem, the allocation of property rights over the externality has real effects on social welfare. We investigate the relative efficiency of property rights regimes used in practice: injunctions, damages, the ruling in the Spur Industries case, etc. The first best can be obtained by allocating property rights (in particular the right to sue for damages) to the second mover. Allocating property rights to the first mover, as a "coming to the nuisance" rule entails, leads to overinvestment. In contrast to conventional wisdom, this inefficiency persists even if a monopoly landowner controls all the land on which the parties may locate.

Collusion with Secret Price Cuts: An Experimental Investigation

With Robert Feinberg

Economics Bulletin, 2002, 3 (6): 1-11.

Abstract: Theoretical work starting with Stigler (1964) suggests that collusion may be difficult to sustain in a repeated game with secret price cuts and demand uncertainty. Compared to equilibria in games of perfect information, trigger-strategy equilibria in this context result in lower payoffs because punishments occur along the equilibrium path. We tested the theory in a series of economic experiments. Consistent with the theory, treatments with imperfect information were less collusive than treatments with perfect information. However, in the imperfect-information treatments, players seemed to settle on the static Nash outcome rather than using trigger strategies. Players did resort to punishments for undercutting in perfect-information treatments, and this sometimes led to successful collusion afterward.

Vertical Foreclosure in Experimental Markets

With Stephen Martin and Hans-Theo Normann

Rand Journal of Economics, Autumn 2001, 32 (3): 466-496.

Abstract: We report the results of experiments designed to test recent theories of vertical foreclosure. Consistent with the theory, vertical integration improves the upstream firm's ability to commit to restricting output to the monopoly level, as does the use of public contracts. Public contracts are not a perfect substitute for vertical integration, however: integration allows more surplus to be extracted from the unintegrated downstream firm, a bargaining effect that has been underemphasized in the recent foreclosure literature. Motivated by some observations that are difficult to reconcile with existing theory, we extend the theory to allow downstream firms to have heterogeneous (rather than purely passive or symmetric) out-of-equilibrium beliefs.

Bidding Behavior in the Department of Defense's Commercial Activities Competitions

With Robert Trost and R. Derek Trunkey

Journal of Policy Analysis and Management, Winter 2001, 20 (1): 21-42.

Abstract: From 1978 to 1994, the Department of Defense conducted more than 2,000 competitions in which private contractors and the government's in-house team bid to provide a service performed in-house before the competition. A three-equation model is constructed, which is used to estimate the in-house bid, the minimum contractor bid, and the in-house team's baseline cost. The model accounts for the fact that the in-house bid is constrained not to exceed its baseline cost. The estimates are used in simulations of the savings from the completed competitions ($1.6 billion annually, 35% of the baseline cost) as well as the savings from various alternative policies, including competitively tendering all the functions on the Department of Defense's list of potential candidates ($7.6 billion annually).Abstra

Reducing Government Spending with Privatization Competitions: The Department of Defense Experience

With Robert Trost and R. Derek Trunkey

Review of Economics and Statistics, February 2001, 83 (1): 108-117.

Abstract: In a privatization competition, private contractors bid against an in-house team to perform a governmental function that is currently performed by the in-house team. The Department of Defense initiated 3,500 privatization competitions from 1978 to 1994, generating estimated annual savings of $1.5 billion. We estimate a reduced-form model of the savings from these competitions that takes into account the premature cancellation of some competitions and the censoring of the in-house bid at current cost. The Department of Defense maintains a list of candidates for future privatization competitions. Using our model, we forecast annual savings of $5.7 billion if privatization competitions were completed for all functions on this list.

Information Sharing and Competition in the Motor Vehicle Industry

With Maura Doyle

Journal of Political Economy, December 1999, 107 (6): 1326-1364.

Abstract: Up to six months ahead of actual production, U.S. automakers announce plans for their monthly domestic production of cars. A leading industry trade journal publishes the initial plans and then a series of revisions leading up to the month in question. We analyze a panel data set spanning the years 1965–95, matching the production forecasts with data for actual monthly production. We show that a firm's plan announcement affects competitors' later revisions of their own plans and eventual production. The interaction appears to be complementary: large plans or upward revisions cause competitors to revise plans upward and increase production. The results are consistent with theoretical models in which firms share information about common demand parameters.

Bounding the Benefits of Stochastic Auditing: The Case of Risk Neutral Agents

Economic Theory, July 1999, 14 (1): 247-253.

Abstract: In the context of a costly-state-verification model with a risk-neutral agent having limited liability, it has been postulated that allowing stochastic auditing reduces the asymmetric information problem to a trivial one: i.e., the first best can be approached arbitrarily closely with feasible contracts. This paper proves the postulate to be false: the surplus from feasible contracts is bounded strictly below the first-best surplus level. The bound is straightforward to compute in examples. The paper thus removes a justification for the restriction to deterministic auditing commonly made in the literature.

The Role of Buyer Size in Bilateral Bargaining: A Study of the Cable Television Industry

With Tasneem Chipty

Review of Economics and Statistics, May 1999, 81 (2): 326-340.

Abstract: We examine the effect of buyer merger on bilateral negotiations between a supplier and n buyers. Merger may have bargaining effects in addition to the usual efficiency effects. The effect of merger on the buyers' bargaining position depends on the curvature of the supplier's gross surplus function: merger enhances (worsens) the buyers' bargaining position if the function is concave (convex). Based on a panel of advertising revenue in the cable television industry, our estimates indicate that the gross surplus function for suppliers of program services is convex. This result suggests that cable operators integrate horizontally to realize efficiency gains rather than to enhance their bargaining position vis-a-vis program suppliers.

Loan Commitments and the Debt Overhang Problem

Journal of Financial and Quantitative Analysis, March 1998, 33 (1): 87-116.

Abstract: The debt overhang problem is shown to arise in the context of an entrepreneurial project that requires a sequence of investments financed by an outside lender. The entrepreneur, not internalizing losses accruing to the lender which financed the initial investments, may inefficiently cancel the project and instead pursue an outside opportunity. It is shown that loan commitments (contracts that allow the entrepreneur to borrow a variable amount at a set interest rate in return for a fixed fee) are the optimal financial contracts in this setting, strictly dominating standard debt. The existence of the fixed fee allows loan commitments to set a relatively low interest rate, improving the entrepreneur's incentives to continue the project. The paper specifies the optimal contract fully, derives robust comparative statics properties, and extends the results to more realistic settings (e.g., allowing the market risk-free rate to be stochastic).

Why Do Larger Buyers Pay Lower Prices? Intense Supplier Competition

Economics Letters, February 1998, 58 (2): 205-209.

Abstract: The paper provides a theoretical explanation of the common claim that larger buyers pay lower prices. In the model, suppliers compete more aggressively for the business of larger buyers, much as they do in `boom' periods of Rotemberg and Saloner.

Is No News Bad News? Information Transmission and the Role of Early Warning in the Principal Agent Model

With Steven Levitt

Rand Journal of Economics, Winter 1997, 28 (4): 641-661.

Abstract: The standard principal-agent model neglects the potentially important role of information transmission from agent to principal. We study optimal incentive contracts when the agent has a private signal of the likelihood of the project's success. We show that the principal can costlessly extract this signal if and only if this does not lead her to intervene in the project in any way that will influence its outcome. Intervention undermines incentives by weakening the link between the agent's initial effort and the project's outcome. If possible, the principal commits not to cancel some projects with negative expected payoffs. To elicit early warning, contracts must reward agents for coming forward with bad news.

Negotiation and Renegotiation of Optimal Financial Contracts under the Threat of Predation

Journal of Industrial Economics, September 1996, 45 (3): 325-343.

Abstract: The paper examines the effect of renegotiation on the ability of financial contracts between a lender and entrant to deter an incumbent's predation. In the presence of renegotiation, it is more difficult for the entrant to obtain financing and more difficult for the contract to deter predation. Contracts successfully deter predation in some cases, however, even if renegotiation occurs at a stage with symmetric information between the entrant and lender. Giving the entrant (constrained by limited liability) stronger bargaining power vis-à-vis the lender improves the efficiency of the optimal contract, but the results concerning renegotiation are unchanged.

A Dynamic Theory of Countervailing Power

Rand Journal of Economics, Winter 1996, 27 (4): 747-769.

Abstract: In this article I develop a model of an infinitely repeated procurement auction with one buyer and several sellers. The buyer can accumulate a backlog of unfilled orders which, similar to a boom in demand, forces the sellers to collude on a low price to prevent undercutting. If the buyer's cost of shifting its consumption over time is low enough, then the extent of collusion is bounded away from the joint-profit-maximizing level even for discount factors approaching one. The model is extended to allow for multiple buyers. Large buyers are shown to obtain lower prices from the sellers. Buyer mergers increase profit for all buyers, not just the merging pair, at the expense of the sellers. In contrast, buyer growth through addition harms buyers that do not grow and benefits sellers.

Empirical Studies of Vertical Foreclosure

Industry Economics Conference Papers and Proceedings (University of Melbourne and Bureau of Industry Economics), November 1995, 95/23: 98-127.